How to profit from a recession

In times of recession its easy to be despondent and downbeat, but take a look at the story of Jesse Livermore who profited from the great depression of 1929 to become the world’s richest man at that time. Learn how he did it and learn how you can use the same method today to profit from any recession and a downturn in the general economy.

Jesse Livermore

Jesse Livermore (July 26, 1877 – November 28, 1940) was an American stock trader. At one time, he was the world’s richest man.

Livermore was born in Massachusetts, to a poverty-stricken family. At the age of 14, his father pulled him out of school to help with the farm, however, with his mother’s blessing, Livermore ran away from home. He then began his career by posting stock quotes at the Paine Webber stockbrokerage in Boston, earning $5 per week.

At the age of 15, he placed $5 on Chicago, Burlington and Quincy Railroad at a bucket shop, a type of establishment that took leveraged bets on stock prices but did not buy or sell the stock. He earned $3.12 on the $5 investment. Livermore was soon earning more trading at the bucket shops than he did at Paine Webber. At the age of 16, he quit his job and began trading full-time.

His first big windfall came in 1901 at the age of 24 when he bought stock in Northern Pacific Railway. He turned $10,000 into $500,000.

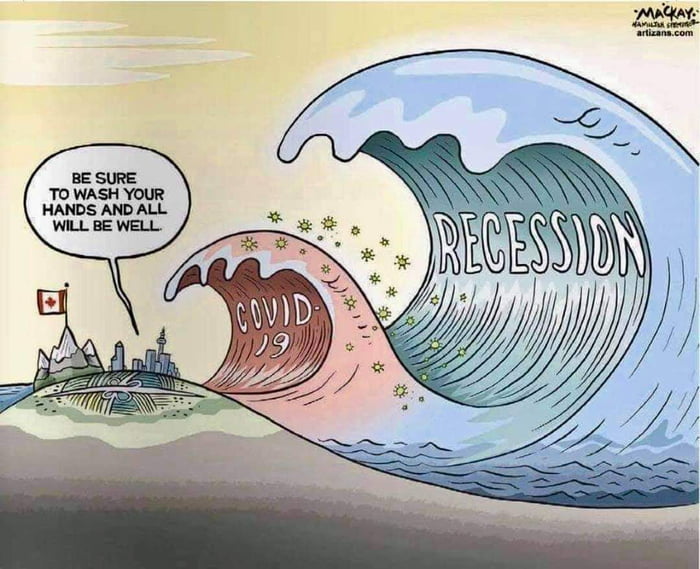

From 1929 to 1939 however the Great Depression was the worst economic downturn in the history of the industrialized world, some 15 million Americans were unemployed and nearly half the country’s banks had failed.

Upon the Wall Street Crash of 1929 Jesse Livermore netted approximately $100 million (approx 1.4 billion in today’s money) from shorting the stock market!

The Epiphany….“Shorting” the stock market.

Whilst most people are familiar with the simple principle of buying shares and making a profit when they rise in price it is not common knowledge that the reverse is also true i.e. that you can make a profit when the market falls from “going short on a share” or the market itself.

Just in case you didnt catch that extremely important but not commonly known concept, lets repeat it… “you can make a profit when the market falls from “going short on a share” or going short on the market itself i.e. FTSE, Dow etc.

A Short Position is a technique used when an investor anticipates that the value of a stock or the market will decrease. Quite simply if you “go short” on a share or the market you make money if the price goes down and lose money if the price goes up. A short position on a stock is a method of short term investing that is not common among the average investor but is a fairly simple method available to anyone.

In a time of recession and depression whilst most people were losing their jobs and homes Jesse Livermore was able to profit from all of the chaos to become the richest man in the world.

For more information on…

How to start short trading

How to use a leveraged account i.e. how to use somebody elses money

How to minimise your risk

How to maximise your profit

Contact us through our Business Coaching & Support programme, be sure to mention short trading in your message…

Has Your Business

Got Wings?

Ever wondered about the full potential of your business?

Are you 100% confident that you have the best possible business strategy in place?

Grow your Business 10x

If you are 100% confident that you have the best possible business strategy in place but your business is swimming in a sea of competition, your marketing isn’t working and you’re struggling to stand out then Time to Fly has been designed just for you.